Introduction: When DIY Becomes Too Expensive

Solopreneurs are natural doers. From sales to social media, you’re used to making things happen without a big team or budget. And when it comes to finances, it’s tempting to keep things in-house. Why pay an accountant or bookkeeper when you can use a spreadsheet and a few YouTube tutorials?

But here’s the problem: DIY finance management may be costing you more than you think — not just in errors or missed deadlines, but in lost growth, wasted time, and stress. As your business grows, what once felt like “saving money” becomes a bottleneck to scale.

This article explores the hidden costs of managing your finances solo, the smarter strategies solo entrepreneurs should adopt, and a roadmap to shift from financial chaos to clarity.

Why DIY Finance Feels Smart (But Isn’t Always)

When you start a business, you’re scrappy — and that’s good. DIY finance tools like Excel, Wave, or QuickBooks Online give you access to bookkeeping, invoicing, and tax prep without hiring anyone.

But here’s the trap:

You assume that spending 10+ hours/month on finance admin is “just part of the job.”

You rely on scattered spreadsheets instead of structured reports.

You skip reviews or projections because “there’s no time.”

According to a 2023 study, the average solopreneur spends 4 to 8 hours per week on finance-related admin tasks — that’s nearly 400 hours a year.

Let’s do the math: If your time is worth even $50/hour, that’s $20,000/year of time spent on something a pro could do for a fraction of that.

Hidden Pitfalls of DIY Finance Management

1. Time Drain That Hurts Growth

The time you spend managing finances is time not spent on client work, marketing, sales, or product creation — the things that actually grow your business.

Example: If it takes you 6 hours to prep for tax season, that’s 6 billable hours or content creation hours gone — with no return unless you’re a finance pro.

2. Risk of Costly Errors

DIY finance often leads to:

Missing deductible expenses

Incorrect tax filings

Inaccurate income tracking

Stat: Accounting mistakes cost small businesses an average of $3,534/year in overpayments, fines, or lost tax refunds (HBK CPA report).

3. Decision Paralysis and Missed Opportunities

When your financial records are unclear or incomplete, it’s harder to:

Know when you can afford to invest

Plan for hiring or scaling

Spot which services are most profitable

DIY finance creates “fog” that makes confident decision-making almost impossible.

The ROI of Outsourcing – What You Really Gain

Outsourcing doesn’t just save you time. It buys you:

Clarity: You get real-time reports, forecasts, and KPIs that help you make strategic decisions.

Confidence: You know your books are accurate, your taxes are compliant, and your numbers are aligned with your goals.

Capacity: You reclaim time for high-impact work that drives income and scale.

In fact, businesses that outsource accounting grow 28% faster than those that don’t (HBK).

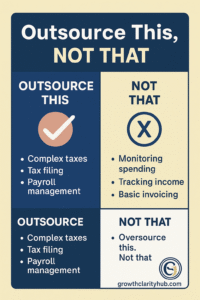

Tasks Worth Outsourcing:

Monthly bookkeeping

Quarterly or annual tax prep

Financial reporting or dashboard setup

Invoicing and payment tracking

When to Make the Switch

Not sure if you’re ready to let go of the spreadsheets? Ask yourself:

Is finance taking >5 hours/month?

Do you avoid reviewing your numbers?

Have you missed payments, deadlines, or deductions?

Do you feel uncertain about when/where to invest?

If you answered “yes” to 2 or more, it’s time.

Start small. You don’t need to hire a CFO. Begin with monthly bookkeeping, then layer on help with tax prep or forecasting. Platforms like Bench, Xendoo, or even local freelancers on Fiverr/Upwork can be affordable and specialized for solopreneurs.

Mini Summary – Key Takeaways

DIY finance management drains time, increases risk, and clouds decision-making.

Outsourcing gives solopreneurs clarity, speed, and confidence to focus on growth.

You don’t have to go all-in overnight — start with the task that takes you longest or stresses you the most.

Smarter financial systems = scalable success.

Conclusion: Turn Finance From a Burden Into a Growth Engine

Doing everything yourself is a rite of passage for solopreneurs. But staying in that mode too long creates drag. The sooner you shift your financial tasks to tools or professionals, the faster you’ll move — and the more peace of mind you’ll gain.

Time is your most valuable asset. Don’t waste it being your own accountant.

Instead, invest that energy in what you do best: delivering value, growing your business, and building something sustainable.

📥 Want to know if you’re ready to outsource?

Download our free checklist:

“10 Signs It’s Time to Outsource Your Business Finances” — and get actionable steps to transition smoothly.