Introduction: Why Bookkeeping Is the First Task Smart Business Owners Let Go

Most small business owners start their journey as a one-person army — doing everything from sales and service to operations and finance. And somewhere along that ride, one task begins to feel increasingly heavy, confusing, and frankly — distracting.

Bookkeeping.

It’s not glamorous. It doesn’t feel like “growth.” And yet, it touches every major decision you’ll make — from hiring your first employee to paying taxes or applying for a loan.

Here’s the truth most new entrepreneurs ignore: Bookkeeping isn’t about math — it’s about clarity.

Outsourcing bookkeeping doesn’t mean giving up control. It means giving yourself the freedom to focus on growth, while ensuring your finances are accurate, up-to-date, and actionable.

What Does a Bookkeeper Actually Do?

Before you outsource, you need clarity on what you’re handing off. A bookkeeper is not just a data entry person — they’re the financial organizer of your business.

Here’s what a professional bookkeeper usually handles:

Recording daily income and expenses

Categorizing transactions

Reconciling bank accounts

Preparing financial statements (Profit & Loss, Balance Sheet)

Invoicing clients and managing accounts receivable

Monitoring bill payments (accounts payable)

Coordinating with your accountant for taxes

By having these systems in place, you reduce financial clutter and decision fatigue — especially when business gets busier.

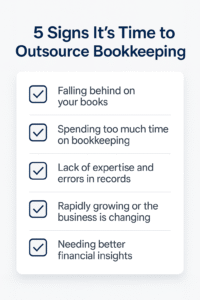

When Is It Time to Outsource Your Bookkeeping?

Not sure if it’s the right time? Here are five clear signs:

You’re spending more than 2–4 hours a week on bookkeeping tasks

You’re behind on invoices, receipts, or reconciliations

You’re unsure about your profitability or cash flow

You dread tax season and scramble to find paperwork

You’re planning to grow and need clear financial insights

If even one or two of these signs resonate with you, outsourcing isn’t a luxury — it’s a business upgrade.

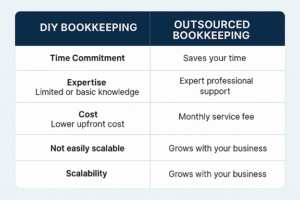

Benefits of Outsourcing Bookkeeping (It’s Not Just Time-Saving)

Sure, outsourcing saves time — but its value goes deeper.

✅ 1. Better Financial Visibility

You’ll have accurate, real-time reports that help you:

Track income vs. expenses monthly

Spot cash flow gaps before they become a crisis

Make informed pricing, hiring, or investment decisions

✅ 2. Reduced Errors and Penalties

Mistakes in your books can cost you — from overpaying taxes to missed deductions or compliance fines. A professional reduces risk significantly.

✅ 3. Less Stress, More Focus

When your finances are sorted, you can finally stop avoiding your dashboard — and start using it to guide your business.

✅ 4. Scalability

Whether you grow to 3 or 30 employees, a bookkeeping system ensures your finances don’t collapse under scale.

How Much Does It Cost to Outsource Bookkeeping?

Bookkeeping costs vary based on:

Business size

Number of transactions

Frequency (monthly, weekly, etc.)

Whether it’s a freelancer, firm, or specialized service

Here’s a quick breakdown:

| Option | Avg. Monthly Cost | Ideal For |

|---|---|---|

| Freelancer (basic) | $150–$300 | Solo entrepreneurs |

| Small bookkeeping firm | $300–$600 | Service businesses with steady clients |

| Online platforms (Bench, Xendoo) | $200–$500 | Tech-savvy founders |

| In-house hire | $2,500+ | Businesses with >$1M revenue |

👉 Tip: Always start with monthly or quarterly services, then scale frequency as your needs grow.

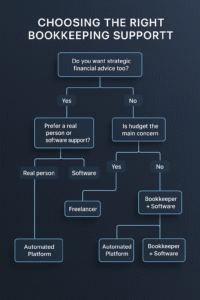

Choosing the Right Bookkeeping Solution

Here’s how to select the right option for you:

🔹 Define your scope

Do you just need basic transaction tracking, or do you want financial strategy insights too?

🔹 Decide tech vs. human-first

Some prefer human bookkeepers; others use software like QuickBooks with virtual support.

🔹 Ask for sample reports

Can the bookkeeper give you a sample monthly P&L, expense summary, and forecast? If not — walk away.

🔹 Evaluate communication style

Do they explain things clearly? Can they align with your decision-making style?

Myth vs Truth — “I’ll Lose Control if I Outsource”

This is one of the most common fears. Let’s bust it:

| Myth | Truth |

|---|---|

| “I won’t know what’s going on in my finances.” | You’ll have clearer, more frequent reports than before. |

| “It’s too expensive.” | Not outsourcing may cost more in mistakes, missed tax savings, or lost time. |

| “Only big businesses outsource.” | Many solo founders outsource first — to grow smarter, not slower. |

Outsourcing doesn’t mean giving up power — it means designing a smarter system.

Mini Summary

Outsourcing bookkeeping can feel like a big leap, but in truth, it’s one of the most strategic first steps a small business can take. It brings clarity, focus, and freedom — and creates space to grow without chaos.

If you’re buried in receipts or unsure about your cash position — the right bookkeeper is not an expense. It’s an asset.

Conclusion: You’re Not “Bad with Numbers” — You’re Busy Running a Business

You didn’t start your business to become a bookkeeper.

But every founder eventually learns: financial clarity fuels every smart decision.

Outsourcing bookkeeping is not a weakness — it’s wisdom. It says:

“I trust myself to lead — and I trust experts to support where it matters.”

So whether you’re a freelancer scaling fast or a growing team ready to upgrade your systems — take the step. Offload the books. Own the growth.